When considering oil and gas reserve valuations, is it more important to be consistent or forward-looking? This is an area of interest for the U.S. Securities and Exchange Commission (“SEC”) and appraisers of oil and gas reserves. The use of a consistent approach across the industry, as the SEC requires, may result in more comparability between various reserves, but the value calculated may deviate significantly from actual transactions and valuations prepared in accordance with Fair Value guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) topic 8201. In this article, we explore the differences between the SEC’s mandated approach and the approach utilized by appraisers when valuing oil and gas reserves in accordance with ASC 820. Fair Value analysis of oil and gas reserves, regardless of methodology followed, often utilize the same starting point—a reserve report prepared by a reservoir engineer2. Methodologies quickly differ past this starting point however as the goal of the SEC is better comparability between oil and gas reserve values while the goal of ASC 820 is to determine the fair value of the reserve. Two significant differences between the SEC’s value and Fair Value relate to commodity pricing assumptions (or price deck) and present value calculations.

When determining commodity pricing, the SEC guidelines require the use of an unweighted arithmetic average of the first-day-of-the month price for each month within the 12-month period prior to the end of the reporting period. The SEC’s method focuses on historical pricing and does not wade into the waters of attempting to forecast what may happen to oil and gas prices in the future.

This approach reduces the volatility that exists in oil and gas pricing, and it achieves a more comparable value as each reserve uses the same methodology to determine price. A fair value analysis, on the other hand, incorporates forward looking price information that was known or knowable as of the specific valuation date3. The SEC acknowledges this difference in the final rule issued on December 31, 20084. The result of a fair value analysis is a forward looking value that may be more indicative of the expected future cash flows to be achieved by a particular reserve, but it incorporates forward looking pricing assumptions that may not be consistent across the industry, thereby reducing comparability.

Present value is another area of difference between SEC reserve report value and fair value. The SEC reserve report value, sometimes referred to as the “PV10” value,5 represents the present value of projected cash flows from proven oil and gas reserves, calculated based on specific rules and assumptions as prescribed by the SEC, and discounted at an annual rate of 10 percent. Through standardization of the calculation of reserve values, the SEC endeavors to improve comparability thereby providing investors with a more “meaningful and comprehensive understanding of oil and gas reserves” intended to assist with the evaluation of relative values of oil and gas companies.

A fair value analysis, however, would likely not allow for a simple assumed discount rate of 10 percent. Analysis of market conditions and associated risks is required under fair value to determine the appropriate discount rate, resulting in a bespoke valuation of the reserves at issue but may reduce comparability between different reserves.

In addition to the two areas discussed above, fair value analysis contemplates numerous other quantitative and qualitative factors that would not be incorporated into a SEC reserve report value including, but not limited to,

- consideration of unproven oil and gas reserves such as probable and possible reserves (i.e., reserves that are considered 50 percent or less likely of being commercially extracted)

- projected oil and gas pricing

- expected cost escalation

- potential tax costs/benefits of a market participant buyer

- abandonment expense or salvage value

- expected risks associated with oil and gas reserves

The introduction of these factors into a fair value analysis also introduces numerous subjective assumptions. Experts’ opinions of price forecasts and cost escalations alone vary significantly, resulting in vastly different opinions of value. Additionally, risk adjustments are often based on survey results, such as those provided by the Society of Petroleum Evaluation Engineers in their annual survey of parameters used in property evaluation, rather than directly observable market information.

As a result of these, and other differences between SEC and fair value reserve reports calculations, values may differ significantly between the two. In fact, the SEC reserve value will only equal the fair value of the reserves by sheer coincidence. Typically, assuming an upward pricing structure, and no immediate plugging and abandonment costs, the Fair Value of the reserves will exceed the SEC reserve report value, due primarily to the inclusion of any probable and possible reserves.

While adherence to SEC reserve reporting requirements removes much of the subjectivity associated with the assumptions utilized in a fair value analysis of oil and gas reserves, it fails to consider many important factors which reasonable investors may consider when evaluating potential investments in oil and gas companies.

Understanding the differences between the two standards of value as they apply to oil and gas reserves will enable users to make more effective business decisions and leave them better equipped to produce SEC compliant financials.

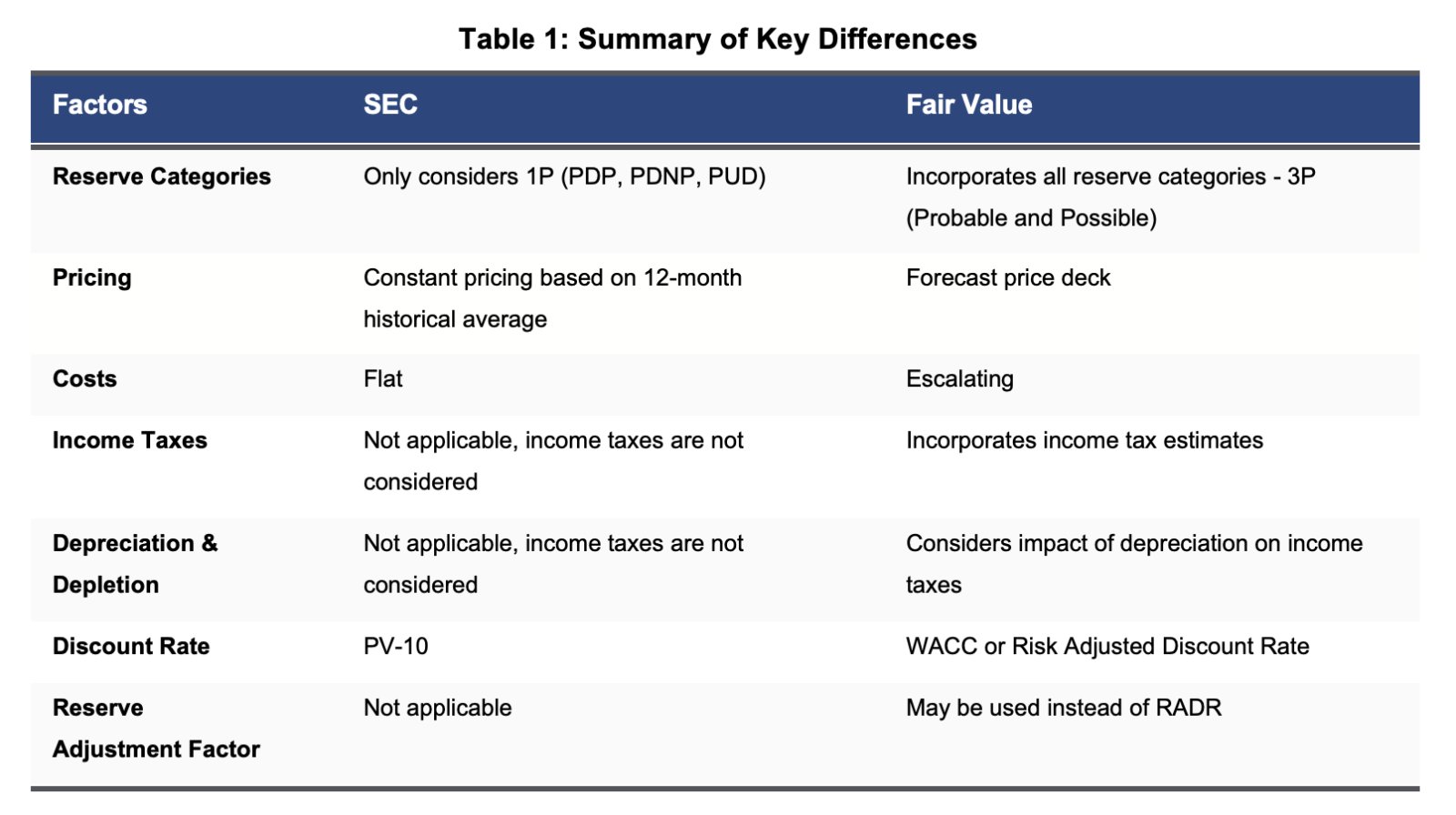

Table 1 provides a summary of several critical differences to consider when comparing SEC reserve calculated values and Fair Value or estimating the Fair Value of oil and gas reserves.

1. Within the valuation profession, as discussed by the Uniform Standards of Professional Appraisal Practice and as defined by ASC 820, the standard of Fair Value reflects actual expected market price as of a specific valuation date. ASC 820 defines Fair Value as “[t]he price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

2. Reserve reports typically provide estimates regarding volume, production, and costs associated with a particular oil and gas reserve.

3. Common sources for forward looking price decks include commodity futures, equity research analysts, petroleum consultants, and the U.S. Energy Information Administration.

4. See Federal Register, Vol. 74, No.9, p. 2161. “If the objective of reserve disclosures were to provide fair value information, we believe a pricing system that incorporates assumptions about estimated future market prices and costs related to extraction could be a more appropriate basis for estimation.”

5. A PV10 value may also refer to non-SEC compliant cash flows discounted at a 10 percent discount rate, but for purposes of this article, we refer to PV10 as the SEC compliant cash flows discounted at a 10 percent discount rate.