INTRODUCTION

On December 22, 2017, President Trump signed the Tax Cuts and Jobs Act (the TCJA) into law, lowering business and individual tax rates, modernizing U.S. international tax rules, and providing for the most significant overhaul of the U.S. tax code since 1986. The law is complex, and it will take some time for professional services providers to digest all the components of the legislation. While many of the provisions of the law may have only an indirect influence on appraisal practice, there are several provisions that will directly affect valuation analyses. Notable provisions that will be discussed in this article include a reduction in the federal corporate tax rate, a limitation on the tax deductibility of net business interest, full expensing of certain property (i.e., 100 percent bonus depreciation), a limitation on the utilization of net operating losses (NOLs) in a given tax year, and the impact on so-called "pass-through entities" (subchapter S corporations, limited liability companies, and partnerships), including a 20 percent deduction for certain qualifying pass-through entities. While there are many other provisions embedded in the TCJA, the focus of this article will be on these topics, which are expected to be the most impactful for the valuation industry.

CORPORATE TAX RATE REDUCTION

Under the TCJA, the U.S. federal corporate tax rate was permanently reduced from 35 percent under the previous tax code, to 21 percent. Unlike some other provisions we will discuss, the reduction in the federal corporate tax rate does not have a sunsetting provision. Obviously, the significant reduction in the tax rate will, all else equal, result in increased valuations. A less pronounced—and partially offsetting impact—will be the increased after-tax cost of debt resulting from the lower corporate tax rate.

Given that the change in the corporate tax rate was far more pronounced (and permanent) relative to the change in the top marginal personal federal income tax rate, which was reduced from 39.6 percent to 37.0 percent (subject to sunsetting at the end of 2025), the tax savings from the TCJA are more pronounced for subchapter C corporations than pass-through entities. However, because most valuation practitioners consider the tax position of C corporations to establish pricing between a hypothetical willing buyer and seller for controlling interest valuations, and as a starting point for the valuation even in valuations of noncontrolling interests,1 the change in the federal corporate tax rate will have an impact on not only C corporations but also on pass-through entities.

LIMITATION ON DEDUCTIBILITY OF NET BUSINESS INTEREST

Section 163(j) of the new tax code limits the tax deductibility of net business interest to 30 percent of adjusted taxable income (ATI), generally measured as earnings before interest, taxes, depreciation, and amortization (EBITDA), for the tax years beginning after December 31, 2017, and before January 1, 2022, and ATI without the depreciation and amortization add-back, generally measured as earnings before interest, and taxes (EBIT) thereafter.2 However, the provision also states that any unused net interest expense can be carried forward indefinitely, similar to NOLs, as discussed later.3

In the instance where a subject company in a valuation is highly levered or has very low forecasted profitability, this provision may negatively impact the value of the subject company. In estimating the impact of the limitation of deductible interest, we have considered three methodologies:

- An adjusted weighted average cost of capital (WACC), in which the cost and weight of non-deductible debt are incorporated alongside the standard debt and equity WACC calculation (see Tables 1 and 2 below);

- A discrete value calculation based on forecasted interest expense and limitations (see Table 3 below); and

- An adjusted present value approach with a discrete add-back of all tax shields.

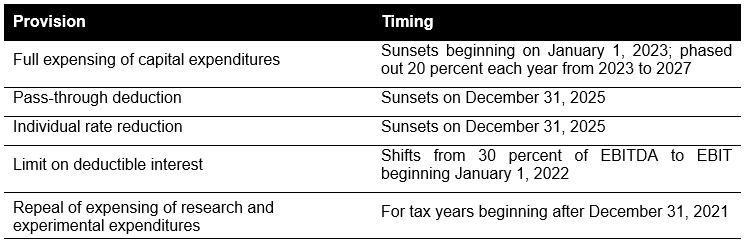

TABLE 1: Limitation of Deductible Interest - Adjusted WACC Example

To calculate an adjusted WACC, the optimal weight on debt financing must be bifurcated between debt on which interest will be deductible and debt on which interest will not be deductible, as presented in Table 1 above. The first step is to calculate forecasted ATI plus depreciation and amortization (EBITDA) in 2018 to 2021 and unadjusted ATI (EBIT) thereafter. Applying the 30 percent limitation to ATI for each forecasted year provides the maximum amount of net interest expense the subject company is permitted to deduct for tax purposes. In this example, projected net interest expense is a circular calculation based on the concluded market value of invested capital (MVIC) because the assumed optimal capital structure is applied to the calculated market value of invested capital to compute outstanding debt, from which interest expense is derived based on the assumed before-tax cost of debt. Net interest expense is grown with EBITDA, which effectively assumes a constant EBITDA valuation multiple, in order to maintain a static implied optimal capital structure over time. Based on the projected net interest expense, one can then calculate any disallowed net interest expense for each forecasted year. At this point, the valuation analyst must select a method to weight the deductible/nondeductible percentages in the initial EBITDA-based limitation period versus the EBIT-based limitation period. The example above assumes an estimated weighting4 of 33.3 percent and 66.7 percent for the EBITDA-based and EBIT-based periods, respectively, resulting in a weighted average of deductible and non-deductible net interest expense to be applied to the selected optimal weight on debt financing. Table 2 below presents the calculation for the adjusted WACC, utilizing the weighted averages of deductible and non-deductible interest previously determined.

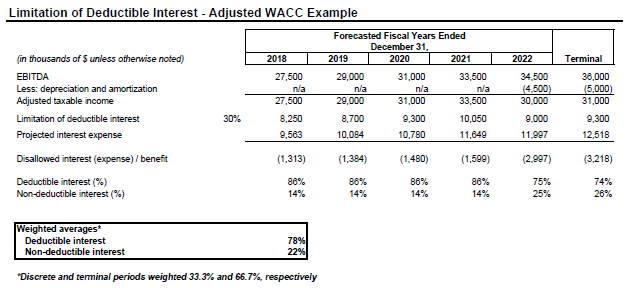

TABLE 2: Limitation of Deductible Interest - Adjusted WACC Example

As presented in Table 2, the adjusted WACC is comprised of the cost of equity (Ke), the cost of debt (Kd), the weight of equity (We), the weight of interest deductible debt (Wd), the weight of nondeductible debt (Wn-d), and the appropriate tax rate (T, which is assumed to be 21 percent for the purposes of this example). We assumed a capital structure comprised of 45 percent debt (78 percent being deductible and 22 percent being non-deductible, as calculated in Table 1). This is similar to the typical calculation of the WACC, except that a portion of the debt, the non-deductible debt, will not benefit from the interest tax shield, and is therefore incorporated in the WACC at the pre-tax cost of debt. All else being equal, this will cause an increase in the WACC, which would lower the value of the subject company.

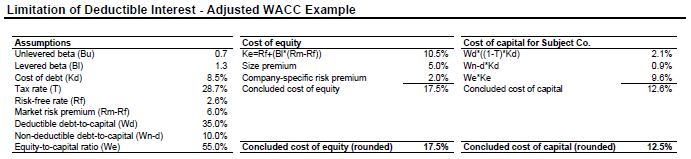

A second proposed methodology for capturing the impact of this provision is to calculate a discrete value of the tax impact of disallowed interest, as presented in Table 3 below. Like the calculation of the adjusted WACC, one first starts by calculating the projected disallowed interest expense. However, instead of taking a weighted average, this approach calculates the tax impact in each forecasted year due to nondeductible interest expense. Then using the WACC,5 one can calculate the present value of the tax effect of disallowed interest expense deduction.

TABLE 3: Limitation of Deductible Interest - Discrete Value Example

A third possible methodology involves adding back a discrete value of the interest tax shield based on the ATI, limitations, and deductible interest used in the previous two examples. The format of this method would be similar to the second methodology but would rely on an unlevered cost of equity to discount cash flows excluding any tax benefits in the income approach, while then separately adding the full value of the interest tax shield (i.e., an adjusted present value approach).

There are many considerations in calculating the effects of this provision. For example, should projected interest expense be based on a subject company's actual capital structure (and projected interest expense) or a market participant capital structure (the answer to this question may depend on whether the valuation is on a control or minority basis)? The actual and market participant constant capital structures may vary significantly for a highly levered investment where regular pay-down of debt is expected (i.e., a typical private equity model). This leads to the next question: Should projected interest expense be grown at a rate to imply a constant capital structure? If interest expense is grown at a rate that implies a constant capital structure, as in our example, this may result in a large carryforward balance that the model suggests will never be utilized. Lastly, considering the shift from EBITDA to EBIT in the limitation calculation, it may be appropriate to extend the forecast until all tax-basis amortization has run off, in order to normalize the terminal period calculation.

FULL EXPENSING OF CERTAIN PROPERTY

Included in the TCJA is a provision for 100 percent bonus depreciation (i.e., immediate expensing) of qualified capital expenditures.6 Additionally, the TCJA revised the definition of qualified property (i.e., property eligible for bonus depreciation) to include used property acquired by purchase, so long as the acquiring taxpayer had not previously used the acquired property and the property was not acquired from a related party. Additionally, the provision raises the Internal Revenue Code (IRC) Section 179 small business expensing cap from $500,000 to $1 million.

This provision is applicable to property put into service after September 27, 2017, and before January 1, 2023. For tax years beginning on or after January 1, 2023, the 100 percent bonus depreciation will be phased out 20 percent each year over the next five years (i.e., 80 percent of qualified capital expenditures may be expensed in 2023, 60 percent in 2024, 40 percent in 2025, etc.). Beyond 2022, once bonus depreciation begins to be phased out, appraisers will need to model a mix of bonus depreciation and MACRS depreciation.

For example, in 2023, qualified capital expenditures will be subject to 80 percent bonus depreciation, while the remaining 20 percent will be subject to traditional tax depreciation rules. Further, in most cases it will be necessary to extend forecasts even beyond the end of the five-year phase-out period in order to reach a normalized relationship between capital expenditures and depreciation in the terminal period.

This provision leads to a number of interesting questions regarding the impact on values, and more broadly, merger and acquisition activity in general. First, barring some exceptions, most capital expenditures between September 27, 2017, and December 31, 2022, may be fully depreciated in the year of acquisition. Assuming a stock transaction, existing tangible assets at the acquisition date will continue to be depreciated, while new capex may be subject to 100 percent bonus depreciation.

Conversely, under an asset sale assumption, all existing tangible assets will be stepped up to fair value and may qualify to be fully depreciated in the year of acquisition, resulting in a significant increase in depreciation, and therefore tax savings, in the first year. Accordingly, asset acquisitions are likely to become even more attractive to buyers. The fair market value and fair value standards do not specify whether the hypothetical transaction between the willing buyer and seller will be a stock transaction or an asset transaction, thus, in control-level transactions, it will be necessary to determine whether an asset or stock transaction should be assumed.

NET OPERATING LOSSES (NOLS)

Changes to the treatment of NOLs are a relatively straightforward component of the TCJA. The revised law now limits the amount of taxable income that may be offset by NOLs to 80 percent of taxable income in each year. The provision also eliminates the carryback of NOLs, but now allows for NOLs to be carried forward indefinitely. NOLs are still subject to limitations under Section 382, consistent with the previous tax code.

PASS-THROUGH ENTITY PROVISIONS

Under the TCJA, certain pass-through entities may qualify for an up to 20 percent deduction of "qualified business income” (QBI). The QBI is defined as "the net amount of qualified items of income, gain, loss, and deduction with respect to any qualified trade or business of the taxpayer”7 (QTB). Any trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees is not considered a QTB, and as such is excluded from taking this deduction.8 The 20 percent deduction is capped under a formula based on W-2 wages and unadjusted basis in qualified property. The exact calculation of the cap on the 20 percent deduction is multifaceted and should be carefully considered by the valuation analyst. Due to the unique nature of the formula, we do not address it in detail in this article; however, bear in mind this must be considered in valuing any pass-through entity for which the QBI deduction is relevant.

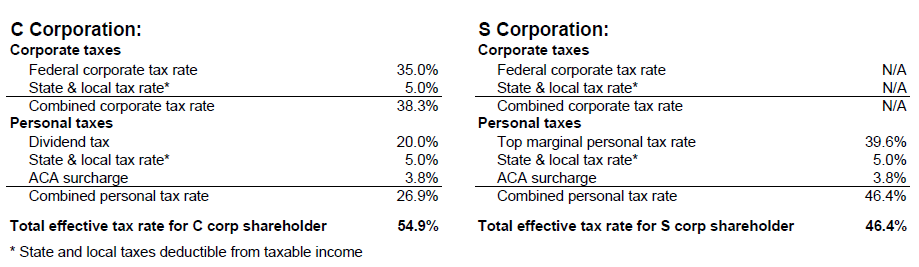

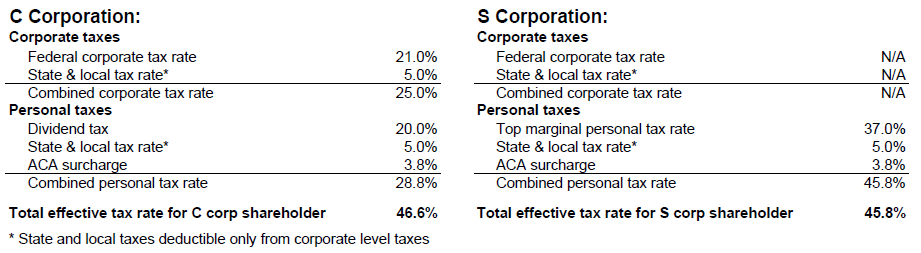

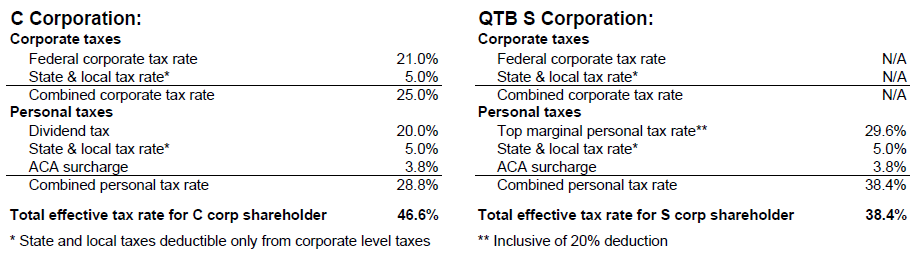

To illustrate the high-level impact from these pass-through changes in the tax code, Tables 4, 5, and 6 present a comparison between a C corporation and an S corporation under three different scenarios. It is important to note that the following examples are of single-period models, which may not be appropriate as the 20 percent QBI deduction expires January 1, 2026. However, for the purposes of this article, the examples below are included merely to illustrate the approximate relationship between taxes for shareholders of a C corporation versus an S corporation during the period when the provision remains in effect.

TABLE 4: Old Tax Law

As shown in Table 4 above, pass-through entities clearly held a tax advantage under the previous tax code, where in our hypothetical example the shareholder of a C corporation kept 45.1 cents of every dollar of taxable income while a shareholder of an S corporation kept 53.6 cents of every dollar. The computed tax benefit of being a pass-through entity under this example was approximately 19 percent.9

TABLE 5: New Tax Law (without 20 percent QBI deduction)

As presented in Table 5 above, it is clear that without the 20 percent deduction, the tax benefit of being a pass-through entity has been all but eliminated. Again, by presenting this under the single-period model, we assume the top marginal tax rate is perpetual, a simplifying assumption for illustrative purposes only. Therefore, it would not be surprising if under a multi-period model, pass-through entities may actually be at a tax disadvantage to C corporations after the top marginal federal personal tax rate reverts to 39.6 percent. As previously discussed, the up to 20 percent deduction, under many scenarios, returns the tax advantage to pass-through entities as shown in Table 6. In jurisdictions with considerable state and/or local income tax rates, pass-through entities may not realize tax advantages because deductibility of state and local taxes is limited to pass-through shareholders under the new rules.

TABLE 6: New Tax Law (with the maximum 20 percent QBI deduction

With the inclusion of the 20 percent deduction to QBI, as presented in Table 6, the top marginal tax rate is effectively 29.6 percent rather than 37.0 percent.10 As a result, in this example shareholders of an S corporation would keep 61.6 cents of every dollar of earnings while the shareholder of a C corporation would keep 53.4 cents for every dollar earned. This yields an implied 15.4 percent benefit for QTBs under the new tax code.11 Again, keep in mind that the 20 percent deduction and reduction to the top marginal personal tax rate do in fact sunset, so the use of a multi-period model will be warranted.

TOPICS FOR FURTHER CONSIDERATION

As with any broad-reaching legislation, many other effects of the tax reform remain hard to immediately gauge. Valuation analysts will need to consider myriad implications and unforeseen consequences on both the overall business landscape, as well as the valuation industry. Below, we address a few additional topics that we believe the profession should work together to address.

Timing of Implementation

Although the TCJA was officially signed into law by the President on December 22, 2017, a version passed the House on November 16, 2017, while the Senate version passed on December 2, 2017. To reconcile the differences between the two bills, the Senate and the House appointed members of a conference committee, which released the revised final bill on December 15, 2017. However, preliminary debate on tax reform began many months prior and was well publicized. Thus, the question arises as to whether the impact of certain provisions of the TCJA should be incorporated into valuation dates prior to December 22, 2017, and if so, how many days, weeks, or months prior. One might argue the terms of the TCJA were reasonably known and would have been anticipated by a hypothetical market participant buyer or seller prior to final passage of the bill. Strong performance observed in the public markets suggests the market was gradually pricing in some form of tax reform in the months leading up to final passage. Depending on the magnitude of the effect of the new tax law on the conclusion of value, the practitioner's decision could be subject to heightened scrutiny in certain cases, especially in situations where the topic of "fairness" is contemplated, such as shareholder buyout disputes. Ultimately, a relevant question is whether the change was reasonably expected or foreseeable.

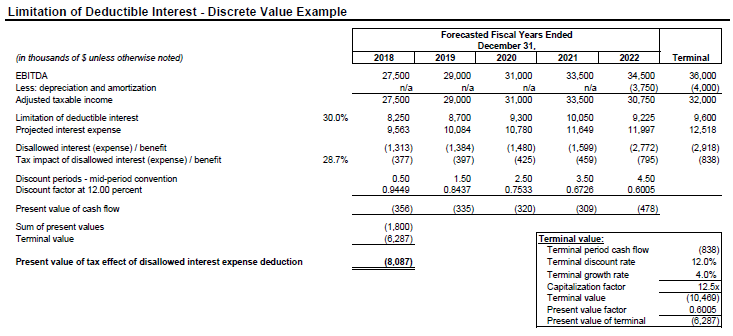

Sunsetting Provisions and Potential Changes to the Law

As discussed previously, many provisions and changes contained in the TCJA are scheduled to sunset. Adding to the uncertainty, questions may arise as to the possibility of extension or renewal of certain provisions and whether such extensions or renewals should be accounted for in valuation analyses on a prospective basis. The chart below summarizes just a few of the significant provisions subject to expiration or phase out.

While we suspect most practitioners will follow models that allow the expiring provisions above to, in fact, sunset without extension, some may attempt to reason that these provisions might be extended by future Congresses. Of course, future Congresses also could modify top marginal rates or add other provisions to the tax code that have not yet been contemplated, so speculating as to future revisions or extensions to the law may be a slippery slope.

Consideration of Hypothetical Transaction Structures

Owing to the lower corporate tax rate and 100 percent bonus depreciation, one could argue that the TCJA has eliminated some of the disparity between the interests of buyers and sellers in deciding on the structure of acquisitions. It reasons that both buyers and sellers may be more aligned regarding asset deals, as they will be less punitive to sellers due to the lower tax rate and are more advantageous to buyers due to the ability to fully expense qualifying acquired tangible assets. However, sellers may recognize the significant benefit to buyers and demand some share of this benefit through higher transaction prices, thereby resulting in a similar view on the part of buyers and sellers as before. In addition to actual deals, this also has implications on what practitioners assume to be the preferred deal structure for a hypothetical buyer and seller, for example when it comes to testing for impairment.

Another factor to consider is that depreciation acceleration provisions could lead to imbalances between depreciation and capital expenditures that would persist for 10 years or more, as discussed previously. Thus, practitioners should exercise judgment in deciding on the length of the discrete forecast period in building a discounted cash flow model.

Potential Impacts to Optimal Capital Structure

One of the significant advantages of debt over equity financing is the tax deductibility of interest expense. This advantage still holds true after the passage of the TCJA, but only to a certain extent for a number of companies. Because of the interest deduction limit, some companies, in particular highly leveraged companies, may find their cost of debt to be higher than before due to a lower interest tax shield benefit. If one were to consider this absent other factors, it would be reasonable to assume that the theoretical optimal capital structure may trend towards a lower level of leverage. However, practitioners are aware that business owners and management take a variety of factors into consideration when deciding on an actual capital structure. Thus, we will have to see how market reactions to this provision affect the model capital allocation theory, optimal capital structures, and market interest rates going forward.

Potential Impacts to Equity Risk Premium

Generally, taxes act to dampen the volatility of cash flows due to the higher tax burden in highly profitable years and the reduction (or elimination) of taxes in less profitable (or unprofitable) years. Thus, the question arises as to whether lower corporate taxes act to increase volatility and, therefore, risk. Thus, a reasonable question for valuation practitioners: Will lower corporate taxes act to impact the equity risk premium? Although a point worthy of consideration, it will take time for empirical data to work its way through the system. Furthermore, it will be difficult to isolate the effects of tax reform given other macroeconomic factors.

Dynamic Between State and Federal Tax Laws

In many cases, state tax law will follow federal law, allowing practitioners to simply model the federal and state taxes as a combined element to the valuation analysis; however, in some cases, state tax law may not follow the federal law. As an example, for federal tax calculations, bonus depreciation can be considered, but potentially not for state tax calculations. Practitioners should be familiar with the relevant state law and consider potential differences between state and federal tax laws in their analyses.

Considerations for the Market Approach

While we have mostly discussed the impact of the TCJA provisions on the income approach, we must also consider the implications on the market approaches. For valuation dates after December 22, 2017, we believe it is reasonable to assume that market data and corresponding valuation multiples will have largely incorporated the impact of tax reform (it is also reasonable to assume that market data in the days leading up to the passage of TCJA would also reflect the effects of tax reform to a certain degree, as investors generally price in anticipated events that are likely to occur).

On the other hand, in instances where comparable transactions that were closed prior to tax reform were utilized in the analysis, a valuation analyst should consider (i) the applicability of the transaction approach in this case; and/or (ii) some form of adjustment to the multiples or underlying metrics, as the prices, earnings, and implied multiples from these transactions would reflect pre-reform tax assumptions.

CONCLUSION

The TCJA resulted in sweeping changes to the tax code and its provisions will have a broad impact on the valuation profession. While the effects of certain provisions are more straightforward and can be easily incorporated into analyses, many aspects of the tax reform will have far-reaching effects on both the overall business landscape and our profession. Thus, in addition to updating valuation models, valuation analysts will need to be trained on and cognizant of the nuances that arise from some of the new provisions as best practices are identified and disseminated throughout our industry. More importantly, practitioners will need to initiate dialogue with clients on the additional considerations and complexities of a valuation engagement arising from the TCJA and the consequent impact on scope, analyses, deliverables, and fees.

1For further discussion of the tax affecting of S corporations, please refer to Understanding Business Valuation: A Practical Guide to Valuing Small to Medium Sized Businesses, fourth edition, by Gary Trugman (New York, AICPA), pp. 667-668.

2For the definition of ATI, please refer to Section 163(j)(8) of the Internal Revenue Code.

3Disallowed net interest expense carried forward is subject to limitation under IRC Section 382. Exceptions to this limitation are written into the TCJA for regulated public utilities and businesses with average annual gross receipts of $25 million or less for the three prior taxable years.

4The 33.3 percent and 66.7 percent weighting on discrete and terminal periods, respectively, is a subjective estimate based generally on overall present value weighting from the two respective periods. We expect this weighting will change over time as more of the relevant period shifts from EBITDA to EBIT as the date of the change in basis of the limitation approaches.

5The WACC in this example is slightly lower than the adjusted WACC because it does not incorporate an adjustment for non-deductible debt, so as not to double count the tax effect of non-deductible interest.

6The TCJA has certain exclusions from the 100 percent bonus depreciation provisions. For example, public utility companies and others exempt from limitations on net interest deductibility are "generally" barred from using bonus depreciation. Other exclusions include, but are not limited to, businesses that have "floor plan financing indebtedness."

7See 26 U.S. Code § 199A(c)(1).

8See 26 U.S. Code § 199A(d)(1) and 26 U.S. Code § 1202(e)(3)(a).

9Computed tax benefit calculated as 53.6/45.1 -1 = 18.8 percent.

10Effective top marginal personal tax rate calculated as 37 percent x 0.8 = 29.6 percent.

11Computed tax benefit calculated as 61.6/53.4 - 1 = 15.4 percent.