The M&A Market for P&C Insurers: 2016

This article was originally printed in the March 2016 issue of IRMI Magazine. Read it here.

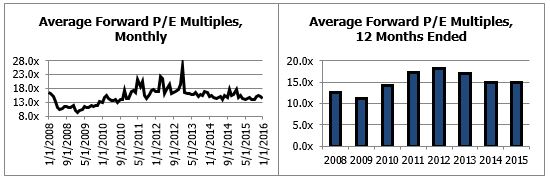

During the consideration of an acquisition or sale of a business, it is common to assess the multiples of publicly traded companies operating within the business's industry. Figure 1, as shown below, graphically presents the average monthly forward price-to-earnings (P/E) multiples of domestic, publicly traded companies operating in the property and casualty (P&C) industry.

FIGURE 1 - AVERAGE FORWARD P/E MULTIPLES1

The decrease in forward P/E multiples reflects the recent instability in the equity markets. As volatility increased during much of 2015 and has continued into early 2016, average forward P/E multiples for P&C insurers have receded toward levels similar to those seen in 2010 but still above 2008 and 2009 levels. While the current economic uncertainty places downward pressure on P&C stock prices, larger, more mature industry participants may recognize the opportunity to capitalize on their undervalued counterparts and attempt to achieve growth through acquisitions, potentially at a bargain price.

OVERVIEW OF INDUSTRY TRENDS

The financial performance and M&A activity among P&C insurers is largely tied to the occurrence of catastrophic events, which places stress on insurers by reducing the volume of premiums on which they can earn investment proceeds. Meanwhile, a long period of time without any catastrophic events can soften the pricing cycle, placing pressure on underwriters.2 With the lack of catastrophes and major natural disasters in 2015, P&C insurers are feeling pressure to retain their capital reserves, rather than deploy them into the M&A market. However, larger insurers with healthy reserves who are experiencing stagnant organic growth as a result of these low insurance rates may see M&A activity as their most viable route toward expansion, buying up smaller, more specialized firms to tap into economies of scale.

The combination of sluggish organic growth from operations, record amounts of excess capital, and downward pressure on insurance premiums is creating an environment for P&C insurers to seek out M&A deals to achieve growth through "bolt-on" transactions with businesses that are more fee driven.3 In the P&C space, the advent of digital technologies such as social media, telematics, and analytics is redefining the market, setting the stage for many smaller insurers to specialize and compete in new ways.4 Larger, more established insurers have sought out these smaller, innovative distributors with exclusive books of business to gain market share and customer access.5

Companies seeking to take advantage of these growth areas and segments may be encouraged to engage in consolidation or look to acquire certain business lines. Such activity has already begun during the first months of 2016, with the recent announcement of the acquisition of AgriLogic Insurance Services, LLC, by Aspen Insurance Holdings Limited, as part of their initiative to strengthen their global market share.6 In fact, Aspen's chief executive officer stated that "AgriLogic has an excellent reputation, which reflects the intellectual capital, technical, and risk management expertise within the company, supported by robust infrastructure."7

In addition, the growth opportunities in the industry were seen in the transaction between Mid Atlantic Insurance Services and Patriot National, Inc., which was announced in January 2016.8Patriot, a national provider of comprehensive technology and outsourcing solutions for insurance companies, is set to acquire Mid Atlantic in order to increase its distribution reach. The acquisition will add over 1,100 new retail agencies, expand its P&C services, and add new insurer relationships.9

Additionally, in October 2015, it was announced that AmTrust Financial Services, Inc., entered into an agreement to acquire Genworth Financial Mortgage Insurance Limited in order to expand and diversify AmTrust's business lines into Europe.10 AmTrust stated that, through the transaction, they will acquire an experienced management team with significant expertise and relationships that will help the company grow.11 Industry leaders have stated that the past few years have seen a higher number in large transactions in the P&C industry than the years immediately following the recession.12

ECONOMIC FACTORS

A key driver of financial performance for P&C insurers is the health of the fixed income market. Insurers charge premiums to their policyholders and invest those funds in fixed income securities to earn investment income. In December 2015, the Federal Reserve announced plans to raise interest rates in 2016, which could contribute to higher investment yields for insurers.13 These additional proceeds could serve as a catalyst for potential acceleration in M&A transactions for 2016, as P&C providers look to capitalize on stronger financial flexibility and gain market share.

However, despite the interest rate hike, the macroeconomic landscape remains uncertain. With a multitude of uncertainty in the global economy, including concerns with China and the European Central Bank's (ECB) fiscal policy, 2016 looks to be an especially volatile year for investments, placing added pressure on underwriters. As global market volatility creates greater downside risk, smaller participants in the P&C industry become subject to more and more pressure to grow their base of policyholders.14 Therefore, many insurers may view M&A activity as the only feasible path to growth.15

Along with concerns abroad, domestic GDP growth is projected to remain stagnant in 2016, placing added pressure on organic growth and further supporting the notion that M&A is an effective growth strategy.16 Pent-up demand from dampened M&A growth in 2014 led to an acceleration in acquisitions in the P&C space in 2015 and is likely to carry over into 2016 with record levels of excess capital in combination with additional inflows from higher investment yields.

POLITICAL FACTORS

With open political elections and several regulatory agencies contemplating the enhancement of compliance standards for insurers, 2016 looks to bring heightened political and regulatory uncertainty for P&C insurers. Presidential, congressional, and state elections could result in radical change for insurers. Regardless of the outcome of any election, the lack of an incumbent candidate for the presidency means that there will undoubtedly be changes made to the political environment within which the P&C industry operates.

In addition to exerting influence over insurers with rate increases, the Federal Reserve is preparing new standards on capital requirements for large insurers. Therefore, insurers will need to manage the deployment of their excess capital with this looming regulatory change in mind.

Finally, the National Association of Insurance Commissioners (NAIC) is pursuing more robust standards for reporting and compliance, indicating that increasing costs could be on the horizon for insurers as they bolster their back office functions to operate within the NAIC's reporting and compliance requirements. P&C insurers will have to work to ensure that they are able to meet these updated compliance standards without hindering their ability to provide a quality customer experience or creating a spike in customer service costs and elevated cyber risks. These motivations could serve to accelerate M&A activity as insurers look to create cost synergies in order to offset higher compliance and reporting costs.

OUTLOOK

In the absence of any major catastrophes, underwriters will continue to feel added pressure as organic growth prospects begin to diminish. However, with a lack of claims from policyholders, insurers will continue to experience record levels of excess capital, which they could deploy into the M&A space to achieve growth in 2016. The positive outlook on investment yields for insurers can also been seen as an indicator of bolstering M&A activity in the P&C market as larger firms take advantage of more financial flexibility and look to expand their market share. Finally, as the P&C industry continues to be influenced by the advent of digital technology and data analytics, smaller, more specialized firms with expertise in new technologies are likely to field offers from larger insurers looking to create cost efficiencies and wield these proprietary data and customer relationship technologies on a grander scale.

Nevertheless, macroeconomic and regulatory uncertainty may also draw some P&C industry participants' attention toward bracing for geopolitical uncertainty and away from pursuing growth in the M&A marketplace, thus limiting the amount of industry transactions.

1Data obtained from S&P Capital IQ.

2 IBISWorld report 52412-Property, Casualty and Direct Insurance in the US… page 4.

3 "2015 Insurance M&A Outlook." Deloitte.com. Deloitte Touche Tohamatsu Limited. Web. 11 February 2016.

4 "2016 Insurance M&A Outlook." EY.com. Ernst & Young LLP. Web. 11 February 2016.

5 "2016 Insurance Market Outlook." WellsFargo.com. Wells Fargo & Company, Inc. Web. 11 February 2016.

6 "Aspen Group Announces Acquisition of AgriLogic Insurance Services LLC." BusinessWire.com. Business Wire, a Berkshire Hathaway, Inc. subsidiary. Web. February 26, 2016.

7 Ibid.

8 "Patriot National Acquires Mid Atlantic Insurance Services." Prnewswire.com. PR News Wire. Web. February 26, 2016.

9 Ibid.

10 "AmTrust Financial Services, Inc. Announces Agreement to Acquire Genworth Financial Mortgage Insurance Limited, a European Mortgage Insurer." Globalnewswire.com. Global News Wire. Web. February 26, 2016.

11 Ibid.

12 "Seeking Growth: M&A Outlook for 2015." PropertyCasualty360.com. Property Casualty 360. Web. February 26, 2016.

13 Federal Open Market Committee. (2015, December 16). FOMC Press Release [Press release]. Retrieved February 11, 2016, from http://www.federalreserve.gov/newsevents/press/monetary/20151216a.htm

14 "2016 Insurance M&A Outlook." EY.com. Ernst & Young LLP. Web. 11 February 2016.

15 Ibid.

16 "2015 Insurance M&A Outlook." Deloitte.com. Deloitte Touche Tohamatsu Limited. Web. 11 February 2016.

Opinions expressed in Expert Commentary articles are those of the author and are not necessarily held by the author's employer or IRMI. Expert Commentary articles and other IRMI Online content do not purport to provide legal, accounting, or other professional advice or opinion. If such advice is needed, consult with your attorney, accountant, or other qualified adviser.