2018 Life Insurance Company Valuations and Interest Rates

Following the recession from 2007 to 2009, interest rates were held at historically low levels as part of the Federal Reserve's accommodative monetary policies to aid economic growth. The low interest rate environment impacted many segments of the economy, including the life insurance industry. As the economy rebounded from the recession, the Federal Reserve began increasing the target rate for interest rates beginning in late 2016. This signaled a reversion of policy from the accommodative low interest rate environment toward monetary policy more in line with historical averages.

The Federal Open Market Committee (FOMC) announced its most recent interest rate increase in September 2018, bringing the target range to 2.00–2.25 percent. This article will discuss the relationship between interest rate risk and the valuation of life insurance companies. In addition, this article will look at the current and expected interest rate environment and touch on ways to mitigate risk attributable to interest rate fluctuations.

VALUATION FRAMEWORK

To understand the framework used to analyze the relationship between interest rates and a firm's equity value, first consider the following formula.

Equity Value = Asset Value - Liability Value

Most of the insurance industry's assets are investments in bonds and other non-equity instruments, while liabilities typically include products sold and the ability to meet policy commitments.1 As a result, life insurance is a liability-driven business as the business model is predicated on taking funds today in exchange for the promise to make payments in the future.2

BUSINESS MODEL

The assets and liabilities of life insurers have a unique relationship. Life insurers collect premiums from policy owners, which they invest in stocks and bonds. With these investments, insurers aim to generate returns in excess of their liabilities through investment income and capital gains.3 This investment income is then shared with policyholders through annuities or the policy's cash value.

As a result of this business model, the life insurance industry is greatly impacted by its exposure to the financial sector, including interest rate risk. Earnings are dependent on the spread between investment returns and the interest paid on each insurance policy or product. When interest rates are low, insurance companies may be unable to meet contractually guaranteed obligations to policyholders solely from investment income, thus causing an increase in premiums.4 As such, insurance companies strive to match liability cash flows with cash flows from investment earnings to avoid liabilities exceeding the life insurer's assets, creating an asset-liability reserve. However, when interest rates are too low, the cash flows may not correlate, exposing insurers to losses from forced asset sales that did not have adequate returns. In these instances, companies will typically see a reduction in earnings.

CURRENT TRENDS

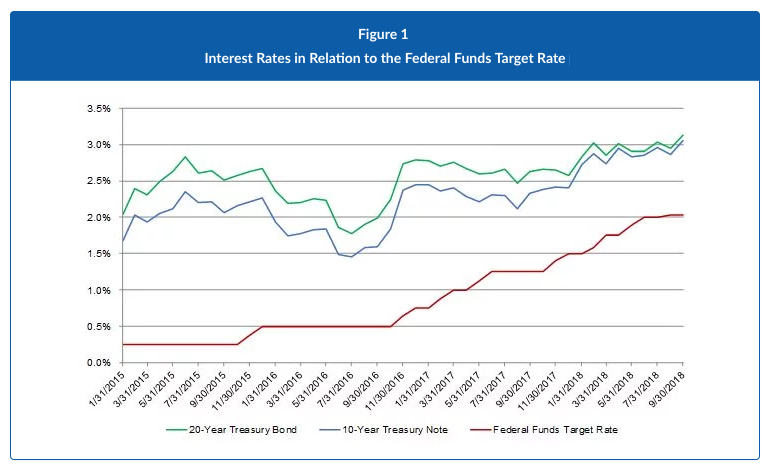

The graph below shows interest rates have slowly expanded since 2016 from the near-zero levels implemented immediately following the economic downturn, thus enhancing investment income earned (Figure 1).5

Fixed-rate annuities and the performance of the S&P 500 in the 5-year period leading to 2018 have also helped improve earnings for life insurance companies. Additionally, similar insurance products to life insurance have been performing better with gradually rising interest rates.6 As interest rates continue to increase, investment income is expected to grow along with the continued improvements in equity markets.7

INTEREST RATE EFFECT ON PRODUCT AND CONSUMERS

Three of the most popular life insurance products include fixed annuities, lump-sum payments, and deposit-type investments.

A fixed annuity promises a specified return on investments for an extended period of time. When rates are low, life insurers only profit from these annuities if the annuity's contracted return is lower than the insurer's investment returns. Accordingly, there is less demand for these products in a low interest rate environment, making this type of product difficult for insurers to sell.8 However, with the recent rise in rates, demand for fixed annuities, specifically for indexed annuity contracts, is strengthening.9

Alternatively, some life insurance policies allow a beneficiary to receive a lump-sum payment upon a policyholder's death. If interest rates are low, a policy's future payments will be covered more from asset sales than investment income, thus increasing the insurer's liability.10 In the current rising interest rate environment, however, this liability is less of a concern for insurers as they are able to cover policy payments with both asset sales and investment income.

Lastly, deposit-type products include guaranteed investment contracts and funding agreements, which are primarily sold to institutional clients. These products function like a bank certificate of deposit, with policyholders receiving interest and principal repayment in the future. These products are solely a savings vehicle, primarily utilized for defined contribution plans.11

INTEREST RATE EFFECT ON EARNINGS

Life insurance companies generate income by generating portfolio returns in excess of what they owe on policies.12 A significant portion of investment income is related to fixed-income securities. The prices and returns of these securities are highly dependent on interest rates. High interest rates allow insurers to generate more investment income from fixed-income securities due to higher yields. Alternatively, low interest rates reduce investment earnings because the income is being reinvested at a lower rate, thus, compounding the earnings spread compression.13

An increasing interest rate environment also creates disintermediation risk. Disintermediation risk refers to the interest rate arbitrage opportunities that arise in a higher interest rate environment that often leads to an increase in the volume of life insurance surrenders by the life insurer's customers.14 As interest rates rise, the disintermediation risk expands as policyholders have the opportunity for greater returns if they withdraw funds from their policy and invest elsewhere.

With the recent interest rate hikes and the expectation that the FOMC will increase the target rate to 3.0 percent in 2019, disintermediation risk is expected to become a larger concern for life insurance companies.15 In such an environment, insurers may be forced to liquidate some of their investments in order to pay off cash withdrawals from their accounts as consumers seek to move funds into higher-yielding investments.16

INTEREST RATE EFFECT ON VALUATION MULTIPLES

When assessing the equity values of life insurance companies, analysts typically use the price-to-earnings (P/E) multiple. The P/E multiple represents the value of a firm's equity per dollar of earnings and can be based on historical earnings, such as net income during the latest 12 months, or forward earnings, such as net income expected in the next 12 months. By analyzing trends in valuation multiples, analysts can gain a better understanding of the market's assessment of a company's growth prospects and risk profile, both of which can be changed by the interest rate environment.

We analyzed the following companies (the "Life Insurance Industry Group") in the life insurance industry and noted that interest rates most likely affected their valuation multiples.

- AFLAC, Inc.

- CNO Financial Group, Inc.

- Lincoln National Corporation

- Manulife Financial Corporation

- MetLife, Inc.

- National Western Life Insurance Company

- Principal Financial Group, Inc.

- Prudential Financial, Inc.

- Sun Life Financial, Inc.

- Torchmark Corporation

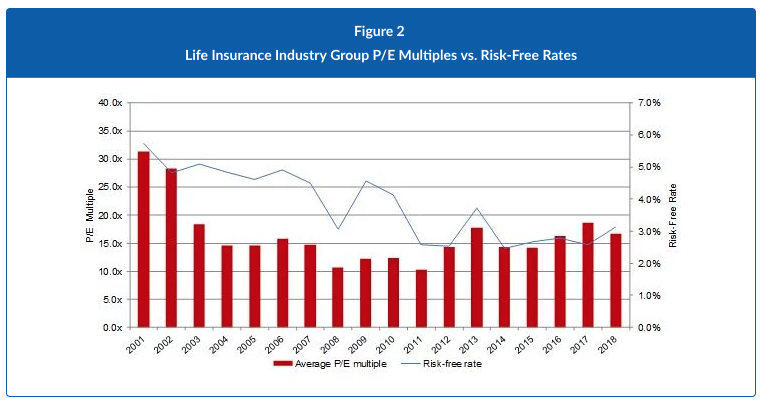

Using market data obtained from S&P's Capital IQ, the following graph compares P/E multiples to the risk-free rate for each year, using 20-year treasury bond rates, and suggests that during periods of prolonged low interest rates, there is more perceived risk for life insurance companies (Figure 2). The graph uses data from December 31 of each year from 2001 to 2017 as well as September 30, 2018. Slight increases in interest rates seem to promote confidence in the financial stability of these companies, as reflected in higher P/E multiples.

While still below historical levels, interest rates have risen during 2017 and 2018 and are expected to continue to rise in the coming years, enabling improved performance by fixed rate annuities and similar products. The interest rate effect is at least partially due to the fact that life insurance companies are long-term investors with a low tolerance for risk. Accordingly, life insurers typically use fixed-income securities to earn returns. With much of the insurers' investment income relating to fixed-income securities, returns are highly sensitive to interest rate movements. As interest rates have been gradually increasing since the end of 2016, perceived risk within the insurance industry has declined and can be expected to further decline as interest rates increase more regularly over the next few years. Therefore, the P/E multiples have gradually increased over the last few years. Multiples peaked during December of 2017 based on market sentiment that the market was expected to be strong during 2018 with the recent passage of tax reform in the United States, although multiples have moderated for the Life Insurance Industry Group during 2018 despite the higher interest rates.

MANAGING INTEREST RATE RISK

As interest rate volatility can pose a threat to the cash flow of life insurance companies, insurers must attempt to mitigate this interest rate risk and have multiple strategies at their disposal.

One strategy for addressing this risk is duration matching.17 Duration is defined as "the number of years required to recover the true cost of a bond, considering the present value of all coupon and principal payments received."18 As such, the duration of a bond with a coupon will be less than the actual maturity of the bond, with the duration being lower for bonds with higher interest rates. Duration matching involves matching asset duration to liability duration to limit insurers' exposure to interest rate risk, creating an approximate hedge.19 By matching the duration of the assets and liabilities of the life insurance company's portfolio, the price sensitivity of surplus to interest rates is reduced. Increasing the duration of assets allows companies to better match assets with liabilities, which is one of the insurers' key risk mitigation strategies. While, in concept, duration matching is a great solution, duration matching is oftentimes difficult for insurers to achieve, as assets with equivalent maturities are not always readily obtainable.

Another complicating factor of using duration matching is the impact of changes in interest rates, which is typically different on the company's asset and liability portfolios. When duration is mismatched between the assets and liabilities, the insurer takes on a greater amount of risk.

Interest rate risk can also be managed through diversification of products and investments. Large insurers are more capable of managing risk through diversifying assets. Insurers can balance interest-sensitive offerings with non-interest rate sensitive products. With unusually low rates on treasuries in the past 10 years, 54.3 percent of the industry's investment income came from bonds, followed by stocks at 29.5 percent. Other sources of investment income include mortgage loans, contract loans, and real estate holdings.20 Insurers also invest in derivatives such as fixed-income futures and interest rate floors, swaps, and swaptions to mitigate the risk of prolonged low interest rates.21 By using derivatives, a life insurer with a large portfolio of guaranteed death benefit annuities will have the ability to hedge against any decline in the equity markets.

Although insurers attempt measures to manage interest rate risk, the extent to which they can do so is limited, particularly in an environment of prolonged low interest rates. In these situations, insurers will typically lower guaranteed rates on new policies in order to reduce expected future liabilities.22 When interest rates are low, however, insurers are forced to reinvest at lower rates, exacerbating the effect.23 However, now that interest rates are moving toward normalized levels for the first time since the beginning of the recession in 2007, interest rate risk is less of a concern for insurers as the insurer is also able to invest in higher-yielding assets with new premiums received. According to the FOMC's September 2018 meeting, the federal funds target interest rate is expected to rise to a normal range by as early as 2020.24

OUTLOOK

Interest rate volatility can pose a significant challenge to insurers, so understanding the impact of these changes is important. Insurers tend to perform poorly in either very high or very low interest rate environments, causing them to prefer rates at "normal" levels.25

With the FOMC's increase in the federal funds target rate to the 2.00–2.25 percent range, monetary policy and, therefore, interest rates are inching toward becoming more normalized and less accommodative.26 In this normalized interest rate environment, the life insurance industry should see improvement in cash flows, which will aid in reducing reserve requirements and helping insurers recover previous capital positions.27

Overall, it is expected that life insurers' financial performance will improve throughout the rest of 2018 and into the beginning of 2019 due to a favorable economic environment, including the gradual rise in interest rates that is supportive of both revenue and capital improvement. With many economic forecasts indicating a stronger financial market and rising per capita disposable incomes over the next 5 years, US households are anticipated to have more discretionary spending available for life insurance and annuity products.28 Accordingly, higher industry cash flows and stronger balance sheet positions tend to reduce perceived market risk and enhance valuation multiples.

1Anthony Gambardella, Full Coverage: Strong Financial Market Performance Has Aided Industry Revenue Growth, IBISWorld, October 2018.

2Kyal Berends, Robert McMenamin, Thanases Plestis, and Richard J. Rosen, "The Sensitivity of Life Insurance Firms to Interest Rate Changes," Federal Reserve Bank of Chicago, Economic Perspectives, Vol. 37, 2nd, 2013.

3Elijah Brewer III, James M. Carson, Elyas Elyasiani, Iqbal Mansur, and William L. Scott, "Interest Rate Risk and Equity Values of Life Insurance Companies: A Garch-MModel," Journal of Risk and Insurance, Vol. 74, No. 2, June 2007, p. 403.

4"Low Interest Rates," National Association of Insurance Commissioners, March 22, 2018.

5"Federal Funds Target Range—Upper Limit, Percent, Monthly, Not Seasonally Adjusted," FRED: Federal Reserve Economic Data, accessed October 7, 2018.

6Gambardella.

7Ibid.

8"Low Interest Rates."

9"Annuities," National Association of Insurance Commissioners, October 4, 2018.

10Berends.

11John D. III Stiefel, "VI: The Guaranteed Investment Contract (GIC)," Society of Actuaries 50th Anniversary Monograph, October 1999.

12Larry Bruning, Shanique Hall, and Dimitris Karapiperis, "Low Interest Rates and the Implications on Life Insurers," The Center for Insurance Policy and Research Newsletter, April 2012.

13Gambardella.

14David T. Russel, Stephen G. Fier, James M. Carson, and Randy E. Dumm, "An Empirical Analysis of Life Insurance Policy Surrender Activity," Journal of Insurance Issues, Western Risk and Insurance Association, 2013.

15Federal Open Market Committee, "September 26, 2018: FOMC Projections Materials, Accessible Version," Board of Governors of the Federal Reserve System, September 26, 2018.

16Larry Rubin and Xiaokai (Victor) Shi, "Insurance Risk Management at Life Insurers: Dynamically Managing Economic Cycles," Society of Actuaries, June 2010.

17Berends.

18"Bond Duration," Morningstar, accessed July 10, 2015.

19Daniel Hartley, Anna Paulson, and Richard J. Rosen. "Measuring Interest Rate Risk in the Life Insurance Sector: The U.S. and the U.K.," Federal Reserve Bank of Chicago, Working Paper, No. 2016-02, January 2016.

20Gambardella.

21Ibid.

22"Low Interest Rates."

23Gambardella.

24Federal Open Market Committee.

25John Fenton, Mark Scanlon, and Jaidev Iyer, Interesting Challenges for Insurers, Towers Watson, March 2011, p. 3.

26"Minutes of the Federal Open Market Committee, September 25–26, 2018," Board of Governors of the Federal Reserve System, October 17, 2018.

27"Low Interest Rates."

28Gambardella.

Opinions expressed in Expert Commentary articles are those of the author and are not necessarily held by the author's employer or IRMI. Expert Commentary articles and other IRMI Online content do not purport to provide legal, accounting, or other professional advice or opinion. If such advice is needed, consult with your attorney, accountant, or other qualified adviser.